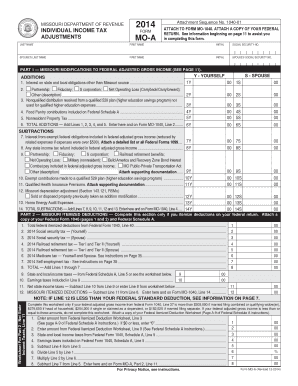

Download 2014 1040 Forms

2014 IT 1040 pg. 1 of 4 2014 IT 1040. Refund or reimbursements shown on IRS form 1040, line 21 for itemized deductions claimed.

2014 Federal Income Tax Forms The IRS no longer accepts 2014 returns electronically. Download, complete, and print out the 2014 tax forms on this page. What If I Need to Prepare and File a Previous Year Federal Tax Return?

Find and complete. Select your state and to file your state return. What If I Need to Correct or Change My Filed and Accepted Federal Tax Return? Learn more on. To amend a state tax return,. Where Do I Find Federal 2014 Tax Forms To Download and Complete?

Download, complete and print the 2014 federal tax forms below. Then sign and mail your return to the IRS.

The information contained on this site is provided for informational purposes only and should not be construed as professional advice. Easy Advance To be eligible for the $3,250 loan amount, your expected Federal refund less authorized fees must be at least $5,095. Actual loan amount may vary.

He told, 'I started trying to rap pretty young and the shit was kind of whack and then I got a little older and I started going around Atlanta performing at certain showcases. Contents • • • • • • • • • • • • • • • Early life [ ] From his early youth, Benton aspired to be a rapper. My grandmas basement jarren benton download slow. After the Funk Volume split up, Jarren created his own record label under the name Benton Enterprises.

An Easy Advance (EA) is a loan secured by your tax refund and is offered by Republic Bank & Trust Company, member FDIC, to eligible taxpayers. There are no fees or interest associated with the EA. Loan is subject to underwriting and approval. EA proceeds are typically available within 24 hours of IRS acceptance of tax return (or within 24 hours for those filing before the IRS start date) however, if direct deposit is selected it may take additional time for your financial institution to post the funds to your account. Visit your Liberty Tax office to learn about the cost, timing and availability of all filing and product options. Valid at participating locations. Cash-In-A-Flash.

Download 2014 1040 Form

Send-A-Friend In-Office Referral Program Valid at participating locations. Referral payment amount, terms, conditions, and availability vary by location and are subject to change without notice. To qualify, your Friend must: (1) Be a new Liberty Tax customer; (2) Present your valid Liberty Send-A-Friend coupon in store; and (3) Prepare, file and pay for their tax return preparation in the store. Discount offer valid only for intended recipient, cannot be combined with any other offer, and may not be used toward past services. Other exclusions may apply. Void where prohibited by law. Liberty Tax School There may be a small fee for books, which vary per market.

Availability is based on classroom capacities per office. Liberty Tax Service has been approved by the California Tax Education Council to offer Liberty Tax School (CTEC Course #2097-QE-0001), which fulfills the 60-hour “qualifying education” requirement imposed by the State of California to become a tax preparer. A listing of additional requirements to register as a tax preparer may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA, toll-free by phone at (877) 850-2883, or on the Internet at Licensed by Oregon Higher Education Coordinating Commission (OAR) 715-045-0033(6).

Students must pass the Tax Preparer examination given by Oregon Board of Tax Practitioners before preparing tax returns for others. In Maryland and New York, additional instruction and requirements are necessary to prepare an individual for employment as a Registered Tax Return Preparer. In Arkansas, Liberty Tax is licensed By the SBPCE State Board.

Download 2013 1040 Form

In Tennessee, students will be offered employment per satisfactory completion. Liberty does not make any promise, warrant or covenant as to the transferability of any credits earned at Liberty Tax Service. Credits earned at Liberty Tax Service, may not transfer to another educational institution. Credits earned at another educational institution may not be accepted by Liberty Tax Service. You should obtain confirmation that Liberty Tax Service will accept any credits you have earned at another educational institution before you execute an enrollment contract or agreement.

You should also contact any educational institutions that you may want to transfer credits earned at Liberty Tax Service, to determine if such institutions will accept credits earned at Liberty Tax Service prior to executing an enrollment contract or agreement. The ability to transfer credits from Liberty Tax Service to another educational institution may be very limited.

Your credits may not transfer, and you may have to repeat courses previously taken at Liberty Tax Service if you enroll in another educational institution. You should never assume that credits will transfer to or from any educational institution. It is highly recommended and you are advised to make certain that you know the transfer of credit policy of Liberty Tax Service, and of any other educational institutions you may in the future want to transfer the credits earned at Liberty Tax Service, before you execute an enrollment contract or agreement.Enrollment in, or completion of, the Liberty Tax Course is neither an offer nor a guarantee of employment, except as may be required by the state. Additional qualifications may be required. Enrollment restrictions apply. State restrictions may apply and additional training may be required in order to become a tax preparer. Valid at participating locations only.